Simplifying GST Compliance for Your Business

Navigating the complexities of Goods and Services Tax (GST) can be challenging for businesses. At CA Yash Garg, we offer comprehensive GST services to ensure smooth compliance with all relevant tax laws and regulations. Our team specializes in GST registration, filing returns, tax planning, and representation before tax authorities.

We understand that each business has unique needs, so we provide personalized GST solutions to help you minimize your tax liabilities while ensuring adherence to GST norms. Our experts assist with GST audits, reverse charge mechanisms, and claim input tax credits to maximize your business’s efficiency and profitability.

With a focus on transparency and accuracy, we aim to streamline your GST processes, reducing the chances of errors and penalties. Whether you’re a small enterprise or a large corporation, we offer scalable GST services that grow with your business. Our proactive approach ensures that your business remains compliant, keeping you ahead of potential tax challenges.

Ensure GST Compliance and Efficiency with Expert Guidance

Streamline your GST registration, filing, and tax planning with CA Yash Garg’s expert services. We ensure compliance, reduce liabilities, and help optimize your tax processes.

GST Registration

GST Return Filing

GST Tax Planning

GST Audit Assistance

Input Tax Credit Claims

GST Compliance Review

Expert GST Tax Solutions

CA Yash Garg offers comprehensive GST services, including registration, returns filing, compliance advisory, and dispute resolution. Our tailored solutions ensure your business meets all tax obligations while optimizing efficiency, minimizing risks, and maximizing benefits. Trust us to guide you through the complexities of GST with precision and expertise.

- GST registration and return filing support

- Comprehensive GST compliance and advisory

- Timely resolution of GST-related disputes

- GST audit and assessment services

- Tailored GST solutions for diverse industries

Known for his commitment to precision and client success, CA Yash Garg delivers exceptional GST services, ensuring businesses meet their tax obligations efficiently and transparently.

Navigating GST Compliance for Business Success

Experience expert GST compliance services with CA Yash Garg. Book a consultation to ensure seamless tax compliance, minimize risks, and drive your business’s growth with confidence.

Trusted GST Compliance Expertise

Partner with CA Yash Garg for customized GST solutions that ensure accuracy, meet regulatory standards, and support the seamless, risk-free growth of your business.

WhatsApp Us

Expert GST Compliance Support

Customized GST Compliance Solutions

Complete GST Compliance Services

GST Compliance & Assurance

Technology-Driven GST Solutions

Dedicated GST Support & Clarity

What Saying Customers

GST can be overwhelming, but Yash made it easy. His knowledge of the system and thorough attention to detail ensured we were always compliant, avoiding any risks or delays.

Pooja Mehta

I trust CA Yash Garg for all my GST needs. His accurate filings and proactive approach helped us stay on top of the latest regulations, ensuring smooth operations and no penalties

Anjali Desai

Thanks to Yash, our GST returns are always filed on time and accurately. He helped us with every step, from registration to filing, making sure we adhered to all laws.

Ravi Sharma

Yash’s GST expertise has been incredibly valuable. He helped us navigate the complexities of GST filing and ensured we were compliant without any issues, saving us time and effort.

Suresh Reddy

Yash’s team made GST compliance simple for our business. Their detailed advice and precise filing helped us avoid any penalties and stay fully compliant with all GST regulations.

Neeraj Agarwal

Frequently Asked Questions

Stay Informed with Expert Insights

Explore expert insights, tax updates, financial news, and business strategies to stay ahead in the ever-evolving financial world.

Read more12A and 80G Registration in Bhopal

Charitable trusts, societies, and non-profit organizations in

Business Setup & Advisory Services in Indi…

India is one of the fastest-growing markets in the world and an attractive destination for foreign companies looking to ex…

Foreign Entity Starting Business in India: The …

Setting up an Indian subsidiary is no longer just about filling out forms; it is a strategic entry into the world’s fastes…

GST Registration in Bhopal – Frequently A…

If you are planning to start a business or expand operations, GST registration in Bhopal is often the fir…

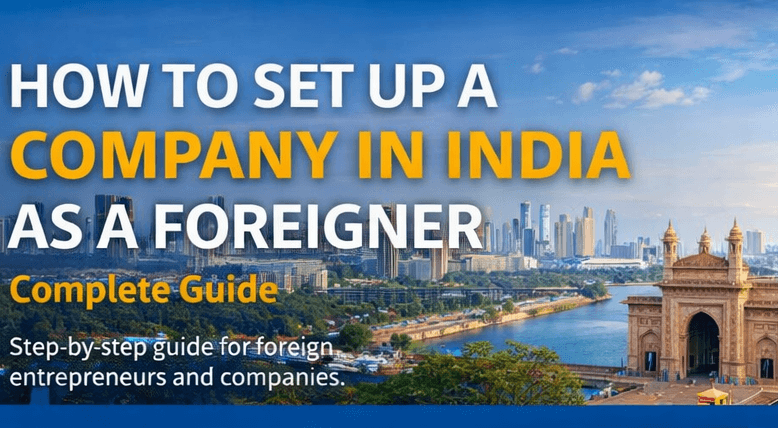

How to Set Up a Company in India as a Foreigner…

India is one of the fastest-growing economies in the world and offers immense opportunities for foreign entrepreneurs and …

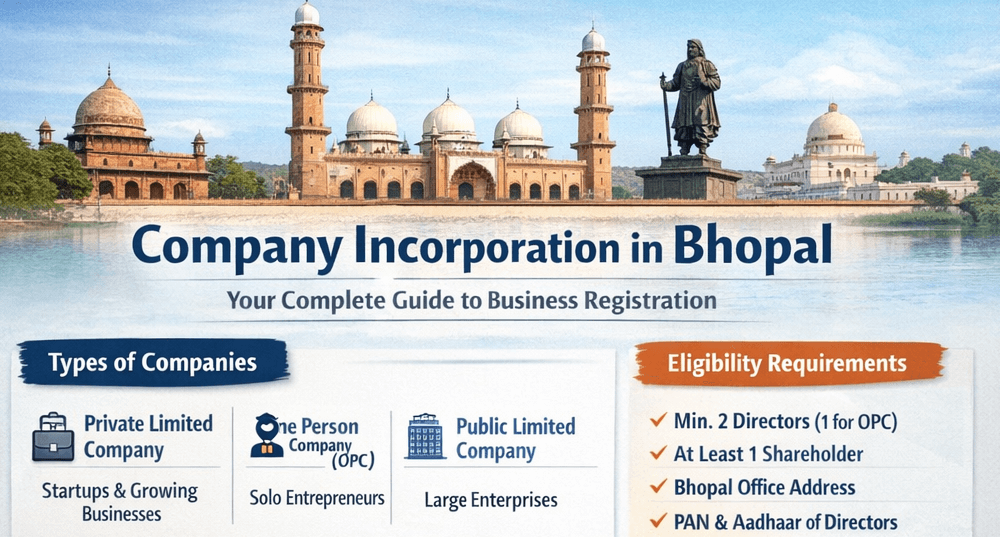

Company Incorporation in Bhopal

Starting a business begins with choosing the right legal structure and completing the incorporation process correctly.

Startup India & MP Startup Policy

India has emerged as one of the fastest-growing startup ecosystems in the world, supported by strong government initiative…

GST Registration in India – A Complete Guide

Goods and Services Tax (GST) registration is the first and most crucial step for businesses to operate legally in India. W…

GST Compliance for Foreign Companies in India

GST compliance for foreign companies in India is a critical legal requirement for overseas businesses sup…

GST Compliance in India

GST compliance in India has become increasingly strict with the introduction of automated reconciliations, data analytics,…