Comprehensive Compliance and Advisory Solutions for Global Trade Success

Navigating the complexities of cross-border trade requires expert financial and regulatory support. At CA Yash Garg, we offer end-to-end Import-Export services for domestic and international clients, helping businesses manage regulatory compliance, optimize taxation, and ensure smooth trade operations. Whether you’re an SME venturing into international markets or a large enterprise scaling exports, we deliver tailored financial advisory and documentation solutions to facilitate hassle-free trade.

Our services include IEC registration, assistance with DGFT compliance, customs duty evaluation, GST refund processing, foreign exchange regulation compliance, and export incentive scheme advisory. We support both exporters and importers by offering up-to-date insights on government schemes, documentation protocols, and international trade finance management.

With in-depth experience in trade regulations and financial strategy, we help clients reduce trade-related risks, improve cash flows, and ensure cost-effective global logistics. Whether you’re importing goods into India or exporting to international markets, we provide professional support that aligns with your business objectives.

With CA Yash Garg, gain a reliable partner to navigate the ever-changing landscape of international commerce. Our expert-driven, technology-enabled Import-Export compliance and advisory services ensure your business remains competitive, compliant, and ready for global growth.

Strategic Trade Advisory and Compliance Solutions for Global Growth

CA Yash Garg offers expert-led Import-Export services for domestic and international clients, ensuring regulatory compliance, optimized taxation, and smooth cross-border trade operations across global markets.

Import Export Code (IEC) Registration

DGFT Compliance and Liaison

Customs & Duty Structure Advisory

GST Refund & Input Credit Processing

Export Incentive Scheme Advisory

Foreign Exchange Management Compliance (FEMA)

Expert Compliance and Taxation Support for Hassle-Free Trade

CA Yash Garg offers specialized import-export services for domestic businesses looking to expand into international markets. Our team ensures end-to-end support starting from Import Export Code (IEC) registration to DGFT compliance, helping you navigate the regulatory landscape confidently.

- IEC registration and documentation

- DGFT and customs compliance

- GST refunds and input credits

- Incentive scheme advisory

- FEMA and RBI guidance

We assist domestic clients in understanding customs duty structures, tax implications, and GST refund processes, making international trade seamless and compliant. With in-depth knowledge of export incentives and foreign trade policies, we empower Indian businesses to grow globally while staying financially sound and legally compliant.

Trusted Expertise for Import-Export Services – Domestic & International

Partner with CA Yash Garg for tailored financial, compliance, and taxation solutions. We help domestic and international businesses streamline cross-border trade and achieve sustainable global growth.

Trusted Expertise for Import-Export Services – Domestic & International

Partner with CA Yash Garg for tailored solutions. We specialize in taxation, compliance, and financial advisory, helping import-export businesses navigate regulations and achieve global success.

WhatsApp Us

In-Depth Expertise for Import-Export Services

Personalized Financial Management Solutions

Proven Advisory Expertise

Taxation and Compliance Expertise

Technology-Enabled Financial Services

Comprehensive Financial Support

What Saying Customers

CA Yash Garg expertise in international trade finance has streamlined our import-export operations, ensuring compliance and efficiency.

Rajiv Sinha

Yash Garg team has provided exceptional support in navigating the complexities of cross-border trade finance.

Amit Khanna

Their in-depth knowledge of international taxation has been a significant asset to our export business.

Sunita Mehta

The team’s assistance in handling customs compliance and documentation has been instrumental in our import operations.

Ramesh Iyer

Their guidance on foreign exchange regulations and documentation has been invaluable in our international dealings

Neha Verma

Frequently Asked Questions

Stay Informed with Expert Insights

Explore expert insights, tax updates, financial news, and business strategies to stay ahead in the ever-evolving financial world.

Read more12A and 80G Registration in Bhopal

Charitable trusts, societies, and non-profit organizations in

Business Setup & Advisory Services in Indi…

India is one of the fastest-growing markets in the world and an attractive destination for foreign companies looking to ex…

Foreign Entity Starting Business in India: The …

Setting up an Indian subsidiary is no longer just about filling out forms; it is a strategic entry into the world’s fastes…

GST Registration in Bhopal – Frequently A…

If you are planning to start a business or expand operations, GST registration in Bhopal is often the fir…

How to Set Up a Company in India as a Foreigner…

India is one of the fastest-growing economies in the world and offers immense opportunities for foreign entrepreneurs and …

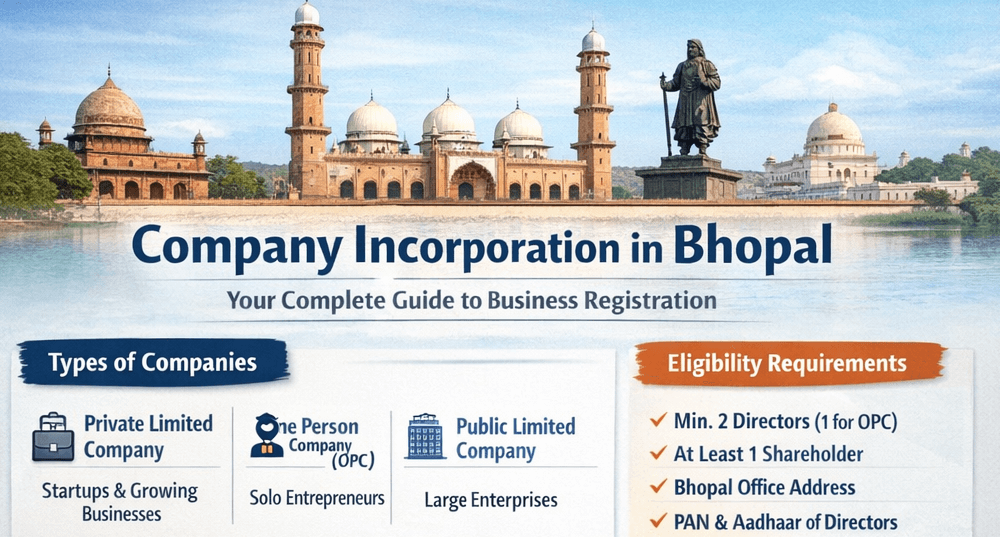

Company Incorporation in Bhopal

Starting a business begins with choosing the right legal structure and completing the incorporation process correctly.

Startup India & MP Startup Policy

India has emerged as one of the fastest-growing startup ecosystems in the world, supported by strong government initiative…

GST Registration in India – A Complete Guide

Goods and Services Tax (GST) registration is the first and most crucial step for businesses to operate legally in India. W…

GST Compliance for Foreign Companies in India

GST compliance for foreign companies in India is a critical legal requirement for overseas businesses sup…

GST Compliance in India

GST compliance in India has become increasingly strict with the introduction of automated reconciliations, data analytics,…