Business Setup & Advisory Services in India for Foreign Companies

India is one of the fastest-growing markets in the world and an attractive destination for foreign companies looking to expand their global footprint. However, setting up a business in India as a foreign entity requires careful planning due to multiple regulatory, tax, and compliance requirements.

We provide business setup and advisory services in India for foreign companies, helping overseas businesses enter and operate in India in a compliant, tax-efficient, and practical manner.

India Entry Advisory for Foreign Businesses

Every foreign business has a different objective—market access, sourcing, execution of projects, or long-term expansion. We advise foreign companies on the most suitable India entry strategy, keeping in mind regulatory approvals, tax exposure, and operational flexibility.

Our advisory work involves regular interaction with authorities such as the Ministry of Corporate Affairs and the Reserve Bank of India, ensuring that your India operations remain fully compliant with Indian laws.

Our Business Setup Services for Foreign Companies in India

India Entry & Structuring Advisory

We assist foreign companies in evaluating and choosing the right structure for India operations, including:

- Wholly Owned Subsidiary in India

- Joint Venture with Indian partners

- Branch Office, Liaison Office, or Project Office

Our advice considers foreign investment regulations, FEMA compliance, and Indian tax implications.

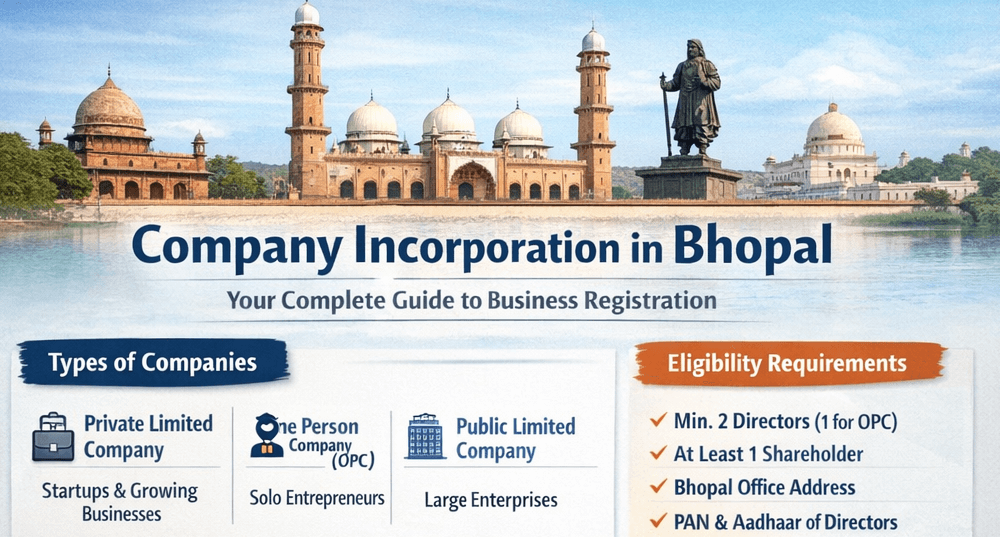

Company Incorporation in India for Foreign Entities

We provide end-to-end support for foreign company incorporation in India, including:

- Company registration with the Ministry of Corporate Affairs

- PAN, TAN, and other statutory registrations

- Assistance with bank account opening and initial compliance

FEMA & FDI Compliance

Foreign investment in India is regulated under FEMA. We assist with:

- RBI and FDI reporting (FC-GPR, FC-TRS, etc.)

- Ongoing FEMA compliance and advisory

- Advisory on sector-specific FDI conditions

Tax & GST Advisory for Foreign Companies

Understanding Indian tax laws is critical for foreign businesses. We provide:

- GST registration and compliance support

- Advisory on permanent establishment risks

- Tax structuring and compliance guidance for foreign entities

Ongoing Compliance & Advisory Support

Post-incorporation, we continue to support foreign companies with:

- ROC and annual compliances

- Accounting and compliance oversight

- Ongoing regulatory and advisory support

Why Foreign Companies Choose Us for India Entry

- Practical, business-focused advisory

- Single-window solution for India entry and compliance

- Strong experience in advising foreign companies operating in India

- Clear communication and timely execution

Many foreign clients engage with us as their India business setup and advisory partner, relying on us for both strategic guidance and day-to-day compliance support.

Planning to Set Up a Business in India?

If you are a foreign company looking to set up a business in India, or an overseas investor seeking reliable India entry advisory, we would be glad to assist you.

Contact us to discuss your India business setup, incorporation, and compliance requirements.